Business Insurance in and around Amarillo

Looking for small business insurance coverage?

This small business insurance is not risky

Your Search For Great Small Business Insurance Ends Now.

Running a business can be risky. It's always better to be prepared for the unfortunate mishap, like a customer stumbling and falling on your business's property.

Looking for small business insurance coverage?

This small business insurance is not risky

Keep Your Business Secure

Protecting your business from these potential catastrophes is as easy as choosing State Farm. With this small business insurance, agent Michael Fox can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

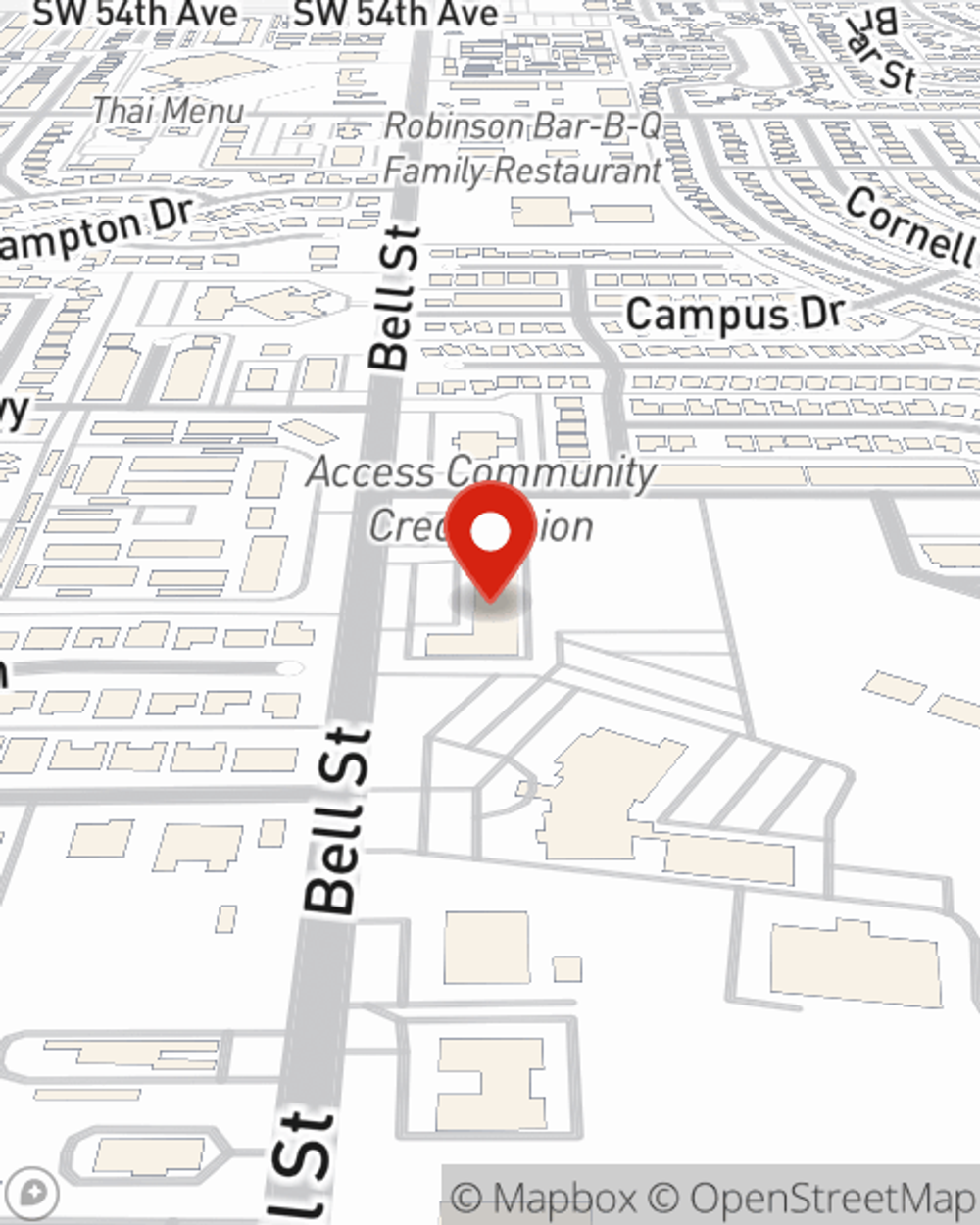

So, take the responsible next step for your business and visit with State Farm agent Michael Fox to explore your small business insurance options!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Michael Fox

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.